Within the ever-evolving healthcare landscape, independent contractors, commonly known as freelancers or self-employed professionals, are integral contributors, offering a diverse array of services ranging from medical billing and coding to patient care and administrative support. The categorization of independent contractors in the health insurance sector is frequently riddled with intricacies and obstacles, especially in the realm of acquiring comprehensive health insurance coverage.

Skip To:

ToggleUnderstanding Independent Contractors: A Definition and Key Characteristics

In the intricate realm of employment, independent contractors, commonly referred to as freelancers or self-employed individuals, play a pivotal role as service providers for companies and organizations. Their status differs significantly from traditional employees, as they operate on a contractual basis, bringing a unique set of characteristics and responsibilities to the professional landscape.

Definition of Independent Contactors in USA Healthcare Insurance

An independent contractor is an individual who engages with a company or organization to provide specialized services under the terms of a contractual agreement. This agreement outlines the scope of work, duration, and compensation for the services rendered.

Key Characteristics Independent Contactors in USA Healthcare Insurance

- Autonomy and Control: Independent contractors maintain a high degree of control over how they execute their tasks. They have the flexibility to set their work schedules, choose their working methods, and determine the best approach to meet project requirements.

- Financial Responsibility: Unlike traditional employees, independent contractors are not part of the company’s regular payroll. They are responsible for managing their own taxes, tracking income, and handling business-related expenses.

- Benefits and Insurance Coverage: Independent contractors do not receive standard employee benefits, such as health insurance, retirement plans, or paid time off. Instead, they are accountable for securing their own insurance coverage and financial planning.

Contractual Arrangements for Independent Contactors in USA Healthcare Insurance

- Independent contractors typically operate under a formal contract that outlines the terms and conditions of their engagement. This includes details such as the project scope, deliverables, deadlines, and compensation structure.

- The contract often specifies that the independent contractor is not an employee and clarifies the temporary nature of the professional relationship.

Tax Implications for Independent Contactors in USA Healthcare Insurance:

- Independent contractors are considered self-employed, leading to distinct tax implications. They are responsible for managing their tax payments, including income tax and self-employment tax, without the assistance of employer withholding.

Business Ownership concerning for Independent Contactors in USA Healthcare Insurance:

- Independent contractors often run their own businesses, obtaining necessary licenses and tax identification numbers. This entrepreneurial aspect highlights their independence and entrepreneurial spirit.

The nuances of independent contractor status are crucial for both the contractor and the engaging entity. It ensures compliance with tax regulations, labor laws, and establishes a clear understanding of the rights and responsibilities of each party involved. As the workforce landscape continues to evolve, the role of independent contractors remains essential, bringing agility and specialized expertise to diverse industries.

Read Also: Culturally Competent Nursing Care: Quality Healthcare

Key characteristics that distinguish independent contractors from employees include:

Understanding the fundamental distinctions between independent contractors and traditional employees is paramount in navigating the complexities of the modern workforce. The key characteristics that set independent contractors apart underscore the unique nature of their professional engagements.

-

Control over Work:

- Independent contractors wield a substantial level of autonomy when it comes to executing their tasks. This autonomy extends to determining their work schedules, methodologies, and the overall approach to fulfilling project requirements.

- This characteristic emphasizes the independence and self-reliance that define the contractor’s role, allowing for adaptability and innovation in meeting project objectives.

-

Financial Independence:

- A hallmark feature of independent contractors is their financial autonomy. Unlike employees who receive regular paychecks, contractors are responsible for managing their own finances.

- Independent contractors navigate the intricacies of self-employment tax, income tracking, and business-related expenses without the support of employer-provided benefits. This financial responsibility reflects their entrepreneurial spirit and self-sufficiency.

-

Business Ownership:

- Independent contractors often function as individual businesses, reinforcing their distinct status in the professional landscape. This involves holding their own business licenses and tax identification numbers, a testament to their entrepreneurial endeavors.

- Possessing these credentials signifies that independent contractors are not merely workers but entrepreneurs who bring a business-oriented mindset to their engagements.

These key characteristics are crucial for both contractors and the entities engaging their services. It establishes a clear delineation of roles and responsibilities, contributing to a transparent and mutually beneficial professional relationship. As the demand for flexible work arrangements continues to rise, the significance of independent contractors in the workforce becomes increasingly apparent, shaping the landscape of contemporary employment.

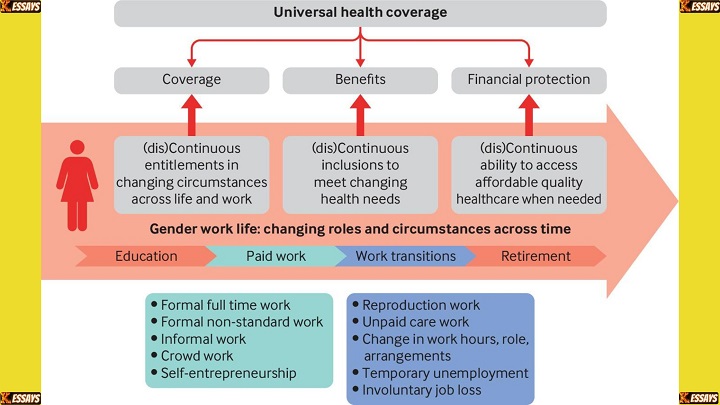

The Challenge of Health Insurance Coverage for Independent Contractors

Securing robust health insurance coverage poses a formidable challenge for independent contractors immersed in the health insurance industry. The nature of their self-employed status places them outside the realm of eligibility for conventional employer-sponsored health insurance plans. Consequently, independent contractors must chart a course through the intricacies of the healthcare landscape, seeking individual coverage via the Affordable Care Act (ACA) marketplaces or engaging with private insurance providers.

-

Exclusion from Employer-Sponsored Plans:

- Independent contractors, operating in a self-employed capacity, do not enjoy the benefits of employer-sponsored health insurance plans. This exclusion represents a critical distinction from traditional employees, who often receive health coverage as part of their employment package.

-

Navigating ACA Marketplaces:

- To address the void left by the absence of employer-sponsored plans, independent contractors turn to the ACA marketplaces. These platforms, such as HealthCare.gov or state-based exchanges, offer a spectrum of health insurance plans tailored for individuals and families.

- Navigating these marketplaces requires a keen understanding of the diverse plans available, as well as an awareness of potential subsidies designed to alleviate the financial burden for qualifying individuals.

-

Engaging with Private Insurance Providers:

- Private insurance providers stand as an alternative avenue for independent contractors seeking health coverage. While offering flexibility in plan selection, these options may come with higher premiums and necessitate a meticulous examination of coverage details.

- Independent contractors must carefully assess and compare plans from private providers to ensure comprehensive coverage that aligns with their individual health needs and financial considerations.

-

Impact on Financial Planning:

- The challenge of health insurance coverage for independent contractors extends beyond immediate health considerations to impact their overall financial planning. Budgeting for health insurance premiums, out-of-pocket expenses, and potential healthcare needs becomes an integral aspect of their financial strategy.

-

Exploring Alternative Options:

- In addition to ACA marketplaces and private providers, independent contractors may explore alternative avenues, such as Association Health Plans (AHPs) or health insurance cooperatives. These options present opportunities for group rates and collaborative coverage solutions for self-employed individuals.

Navigating the labyrinth of health insurance coverage is an essential aspect of the self-employed journey for independent contractors. The choices they make regarding coverage not only impact their immediate well-being but also contribute to their long-term financial stability. As the landscape of healthcare continues to evolve, finding innovative solutions to address the unique challenges faced by independent contractors becomes increasingly vital for fostering a resilient and adaptable workforce.

Read Also: Public Health Finance and Economics

Navigating the Complexities of Classification and Compliance

Determining the professional status of an individual as either an independent contractor or an employee involves a nuanced and multifaceted process, requiring a meticulous examination of the intricacies within the work arrangement. The Internal Revenue Service (IRS) assumes a pivotal role in this classification endeavor, employing a comprehensive set of factors to ascertain the independent contractor status. These factors encompass critical dimensions that delve into the nature of control, financial independence, and the overall relationship between the individual and the company.

-

Control: The Architect of Autonomy

- The degree of control wielded by the company over an individual’s work methods and schedule stands as a fundamental determinant. Independent contractors inherently possess a significant degree of autonomy, determining how they approach and execute their assigned tasks.

- Control, in this context, extends beyond mere oversight; it encapsulates the freedom granted to independent contractors to shape their own methodologies and navigate their work schedules.

-

Financial Independence: The Burden of Profit and Loss

- A critical facet in the classification saga is assessing whether the individual bears the financial responsibility for themselves and faces the inherent risks of profit or loss. Independent contractors, by virtue of their status, are financially self-sufficient entities.

- This financial independence distinguishes them from employees who are shielded from the direct fiscal repercussions of the business’s performance.

-

Relationship: Unraveling the Professional Tapestry

- Examining the nature of the relationship between the individual and the company unveils essential nuances. The existence of a written contract, the provision of benefits, and the permanency of the relationship contribute to the intricate fabric of this professional connection.

- A written contract often formalizes the terms of engagement, defining the scope of work, compensation structures, and the temporary nature of the professional relationship.

The Perils of Misclassification: Legal and Financial Ramifications

Misclassifying an independent contractor as an employee carries profound consequences, both legal and financial, for the company involved. The repercussions may include:

-

Back Taxes:

- Companies may be liable for retroactive taxes owed on behalf of misclassified independent contractors. Addressing these back taxes can pose a considerable financial burden.

-

Penalties:

- Penalties levied by regulatory bodies may accompany misclassification, further compounding the financial strain on the company.

-

Lawsuits:

- The potential for legal action by misclassified individuals adds a layer of complexity. Lawsuits may emerge, seeking compensation for unpaid benefits or withheld rights associated with employee status.

Navigating the complexities of classification and compliance demands a proactive approach, ensuring that companies rigorously adhere to the guidelines set forth by the IRS. The consequences of missteps in this realm underscore the necessity of a comprehensive understanding of the intricate interplay between control, financial independence, and the overall professional relationship. As organizations strive for agility in workforce management, a judicious approach to classification becomes indispensable for fostering legal and financial resilience.

Read Also: Assessing a Company’s Future Financial Health

Strategies for Independent Contractors to Secure Health Insurance Coverage

Securing health insurance coverage is a critical consideration for independent contractors, given their unique status in the professional realm. To address this imperative need, independent contractors can explore various strategies and avenues tailored to their specific requirements:

-

ACA Marketplaces: Tailoring Coverage to Individual Needs

- Enrollment in Individual Health Insurance Plans: Independent contractors can leverage the Affordable Care Act (ACA) marketplaces to enroll in individual health insurance plans. These platforms offer a diverse array of plans, allowing contractors to select coverage that aligns with their individual health needs.

- Subsidies for Eligible Individuals: The ACA marketplaces also present an opportunity for those who qualify to access subsidies. These subsidies serve as financial aids, alleviating the cost burden for qualifying individuals and enhancing the affordability of health insurance coverage.

-

Private Insurance Providers: Balancing Flexibility and Costs

- Purchasing Individual Health Insurance Plans: Opting for individual health insurance plans from private insurance providers provides independent contractors with flexibility in plan selection. However, it’s crucial to conduct a thorough evaluation of the coverage details and associated premiums to make informed decisions.

- Tailoring Coverage to Specific Needs: Private insurance plans often allow contractors to customize coverage based on their specific health requirements. This flexibility ensures that contractors secure comprehensive coverage that addresses their unique healthcare concerns.

-

Association Health Plans (AHPs): Leveraging Group Rates and Benefits

- Joining Employer-Sponsored Health Plans: Independent contractors can explore the option of joining Association Health Plans (AHPs), which are employer-sponsored health plans specifically designed for self-employed individuals and small businesses.

- Access to Group Rates and Benefits: AHPs offer the advantage of group rates and benefits, typically more cost-effective than individual plans. This collaborative approach enables contractors to access a broader range of coverage options at competitive rates.

-

Health Insurance Cooperatives: Embracing Collaborative Solutions

- Joining Member-Owned Plans: Health Insurance Cooperatives, characterized by member ownership and operation, provide an alternative for independent contractors seeking more affordable coverage options.

- Cost-Effective Alternatives: These cooperatives leverage collective bargaining power to negotiate cost-effective insurance solutions, making them an attractive option for those looking to balance comprehensive coverage with budget considerations.

As independent contractors navigate the diverse landscape of health insurance, a strategic combination of these approaches can empower them to tailor coverage to their unique needs and financial considerations. The evolving nature of the healthcare sector underscores the importance of staying informed about available options and proactively adapting strategies to ensure ongoing access to comprehensive health insurance coverage.

Seeking Professional Assistance for Guidance and Support

Navigating the complexities of health insurance coverage for independent contractors can be challenging. Professional writing services like kessays.com, Kesity.com, myassignmenthelp.com, and writersperhour.com offer valuable assistance in understanding the intricacies of independent contractor classification, identifying appropriate health insurance options, and navigating the ACA marketplaces.

These services can provide tailored guidance and support, from assessing individual needs and circumstances to comparing plan options and understanding the implications of different coverage choices.

Read Also: The Legacy of Nursing History Essay

Conclusion: Empowering Independent Contractors with Health Insurance Coverage

Independent contractors play a vital role in the health insurance industry, providing essential services and expertise. Ensuring that these individuals have access to adequate health insurance coverage is crucial for their well-being and the overall health of the healthcare system. By understanding the complexities of independent contractor classification, exploring various health insurance options, and seeking professional assistance when needed, independent contractors can make informed decisions about their health insurance coverage and safeguard their well-being.